For businesses aiming to achieve growth and make a lasting impact in their industry, understanding market potential goes beyond just being beneficial—it’s essential.

One of the core metrics guiding this analysis is the Serviceable Addressable Market (SAM). SAM defines the portion of the Total Addressable Market (TAM) that a company can realistically target and serve with its current products and services, accounting for operational, geographic, and market-specific constraints.

This metric doesn’t just represent potential revenue; it also serves as a strategic guide to identify which market segments align with a company’s strengths and current capabilities.

From my experience as a business lecturer, I’ve seen firsthand how crucial SAM is for students, entrepreneurs, and business professionals who aim to establish a stronghold in their chosen fields.

When SAM is clearly defined, it provides a pathway for effective strategic planning, investment decisions, and product development. Rather than trying to capture an entire market, SAM encourages a more targeted approach, helping businesses direct resources where they’re likely to see the greatest return.

By understanding and accurately evaluating SAM, companies can discover viable growth opportunities, set realistic goals, and avoid the common pitfalls of overestimating market reach.

This article explores SAM’s role in strategic decision-making, how to assess SAM effectively, and the steps to capture market opportunities with clarity and purpose.

Key Takeaways

- Serviceable Addressable Market (SAM) defines the portion of the market a company can realistically target and serve, providing a clear scope of opportunity within the Total Addressable Market (TAM).

- Evaluating SAM allows businesses to identify viable market segments, set realistic growth targets, and optimize resource allocation based on current capabilities.

- SAM is essential for making informed investment and strategic planning decisions, helping businesses focus on the market areas that align best with their strengths.

Understanding the Serviceable Addressable Market (SAM)

The Serviceable Addressable Market (SAM) is a crucial concept in business strategy and market research fundamentals, identifying the specific portion of the TAM that a business can feasibly serve. Unlike TAM, which represents the full market demand, SAM focuses on realistic, serviceable segments, considering factors like geographic reach, regulatory conditions, and product-market fit. This makes SAM a practical metric for guiding resource allocation and strategic planning.

As part of foundational market research fundamentals, SAM allows businesses to concentrate on realistic market opportunities. By zeroing in on reachable market segments, companies can create a focused, actionable pathway to growth. In my role as a lecturer, I emphasize the value of refining TAM into SAM to ensure that strategic plans are grounded in achievable goals.

Importance of SAM in Strategic Planning

The Serviceable Addressable Market (SAM) is essential for effective strategic planning. By focusing on SAM, businesses can develop marketing and sales strategies tailored to reachable customer groups rather than spreading efforts too broadly across TAM. This ensures that marketing and sales activities are targeted and efficient, with each SAM segment representing realistic revenue potential based on current resources.

In my experience teaching business strategy, I advise companies to analyze which parts of the market align with their unique strengths. This approach enables leaders to make informed decisions about resource allocation, resulting in more effective market penetration. Additionally, SAM aids in setting achievable sales forecasts and growth targets, aligning objectives with market realities for sustainable growth. A deeper understanding of strategic market research further supports these insights.

With SAM as a guide, businesses can build strategic plans that are ambitious yet grounded, fostering sustainable growth and a resilient market position.

Assessing Market Size and Segmentation

An accurate assessment of market size and segmentation is crucial for identifying opportunities within the Serviceable Addressable Market (SAM). To effectively define SAM, businesses need to explore methods that assess overall market potential and pinpoint segments that align with their offerings. Two primary approaches are typically employed to achieve this: the top-down and bottom-up methodologies.

Top-Down vs. Bottom-Up Approaches

The top-down approach estimates SAM by starting with the entire market size (TAM) and applying filters like geography, demographics, or customer segments to narrow down to a realistic, serviceable market size. While this method is quicker and provides a general sense of potential, it may overlook nuances in customer needs or preferences within each segment.

On the other hand, the bottom-up approach is a more granular process, where SAM is calculated by aggregating data from specific components, such as sales volume, individual customer count, or product availability. Although this method requires a significant amount of data, it provides more detailed insights and is often more accurate in assessing a company’s real market potential.

In my classroom, I encourage a blend of these approaches for comprehensive analysis. To understand the difference between market research and marketing research, explore this resource, which details these methodologies’ application to SAM.

Market Segmentation Techniques

Effective market segmentation is key to making SAM actionable, allowing companies to focus on customer subsets within SAM that show the highest alignment with their strengths. There are several ways to segment the market:

- Demographic Segmentation: Dividing the market based on age, income, occupation, and education level to understand which groups are most relevant to a product or service.

- Geographic Segmentation: Essential for businesses with location-based strategies, this technique narrows SAM based on regional or local factors.

- Psychographic Segmentation: Examining customer interests, lifestyle, and values helps to tailor messaging and product positioning to resonate with specific audiences.

- Behavioral Segmentation: Focusing on purchasing behaviors, habits, and brand loyalty provides insights into how customers within SAM make buying decisions.

In my experience, utilizing these segmentation techniques within SAM allows companies to craft tailored strategies that increase customer engagement and satisfaction. Each technique provides a different lens through which businesses can analyze customer needs, helping them identify valuable segments within SAM.

How to Calculate SAM

Calculating the Serviceable Addressable Market (SAM) is essential for understanding a company’s realistic market potential. SAM is derived by narrowing down the Total Addressable Market (TAM) to reflect the specific portion that a business can effectively reach with its current capabilities, products, and services. To calculate SAM accurately, businesses need to gather relevant data, assess various market segments, and apply a methodical approach. Here are the main steps:

Step 1: Determine the Total Addressable Market (TAM)

To start calculating SAM, you need a clear understanding of TAM—the overall market demand for a product or service without limitations. TAM is typically a theoretical number that represents the maximum revenue potential if the product or service could serve every potential customer in the market.

For instance, if you’re in the health tech industry, TAM could be the total global revenue generated by health tech services. To dive deeper into this concept, the article on Total Addressable Market (TAM) provides an in-depth look at TAM’s importance and calculation methods.

Step 2: Segment the Market Based on Reachable Factors

With TAM in hand, the next step is to segment the market based on factors that influence your business’s ability to serve particular customer groups effectively. Consider elements such as:

- Geographic Reach: Focus on regions your business can access, considering logistical and regulatory constraints.

- Target Customer Profile: Identify customer characteristics (age, income, occupation) that match your product or service offerings.

- Operational Capacity: Assess your resources, including production, distribution, and customer service capabilities.

By filtering out segments that aren’t currently reachable or relevant, you’ll start to refine TAM into a more actionable SAM.

Step 3: Apply the Top-Down or Bottom-Up Approach

There are two common approaches to calculating SAM:

- Top-Down Approach: Start with TAM and apply specific filters, such as geographic and demographic constraints, to narrow it down. This approach is quicker and often used in the initial phases of market research but may lack detail on specific customer segments.

- Bottom-Up Approach: Calculate SAM by summing up potential revenue from specific customer segments you can realistically serve. This method uses detailed data, such as expected sales volume and customer count within each segment, and generally provides a more accurate picture of SAM.

For instance, in a bottom-up calculation, you might analyze data from sales records to estimate how many units you could realistically sell within each targeted region or demographic.

Step 4: Calculate Potential Revenue from SAM

Once SAM is defined, the next step is calculating the revenue potential within this segment. To do this, consider key metrics like:

- Average Revenue per Customer: Determine the expected revenue from each customer within SAM to project total revenue.

Using these calculations, you can develop a realistic forecast of the revenue potential SAM offers, which aids in setting strategic and financial goals.

Let’s say your company offers eco-friendly packaging solutions, and your TAM is $1 billion globally. However, you only operate in North America and target medium to large e-commerce companies.

By applying geographic and customer-based filters, your SAM might reduce to $200 million, representing the portion of TAM that aligns with your capabilities. Further refinement through market share analysis could reveal that your company could capture 10% of SAM, setting your revenue potential at $20 million.

Defining Target Market Within SAM

Once the Serviceable Addressable Market (SAM) is identified, the next critical step is defining a specific target market within SAM. This involves focusing on the unique characteristics and needs of potential customers that the business can serve effectively. By narrowing down to a target market, companies can concentrate their marketing and product development efforts on a clearly defined audience, increasing the chances of successful engagement and conversion.

In my experience as a business lecturer, I emphasize to students and business leaders alike that data-driven analysis is essential in identifying a precise target market within SAM. Customer feedback, buying patterns, and survey data offer invaluable insights into customer preferences and pain points, guiding businesses to refine their approach and ensure product-market fit. This targeted focus allows companies to craft messages, adjust product features, and develop marketing strategies that resonate deeply with the selected audience.

For instance, analyzing market trends and paying attention to customer preferences help businesses understand which features or benefits matter most to their audience, allowing for tailored offerings that stand out in a competitive landscape. By aligning product offerings with customer expectations, companies within SAM can achieve higher engagement and more consistent sales results.

Ultimately, defining a target market within SAM is not just about focusing on who the company can serve but about building a roadmap to reach these customers in a way that’s impactful and sustainable. By zeroing in on these segments, businesses can leverage SAM to maximize growth and strengthen market presence.

Determining Revenue Potential within SAM

Understanding the revenue potential within the Serviceable Addressable Market (SAM) is essential for businesses aiming to establish clear financial goals and project sustainable growth. By analyzing market share, average revenue per customer, and setting achievable revenue goals, companies can better understand the financial opportunities available within SAM and optimize their strategies accordingly.

Projecting Market Share

To gauge revenue potential within SAM, businesses must first estimate the market share they can realistically capture. This involves evaluating competitor offerings, analyzing industry trends, and identifying the company’s unique strengths. For instance, I often advise my students to consider what percentage of SAM can be served based on a company’s unique value propositions. Understanding the competitive landscape and leveraging advantages, such as pricing, customer service, or innovation, provides a foundation for these estimates.

Strategies to Enhance Market Share:

- Competitive pricing analysis

- Understanding and aligning with customer preferences

- Leveraging brand strengths to differentiate from competitors

Analyzing Average Revenue per Customer

Determining the average revenue per customer (ARPC) within SAM provides businesses with insights into their earnings potential. By calculating ARPC, companies can project their total earnings within SAM based on expected customer volume. Tracking this metric also helps businesses identify spending patterns, assess customer lifetime value, and refine pricing strategies.

Key Metrics to Track:

- Customer lifetime value (CLV)

- Purchase frequency and volume

- Pricing models tailored to target market segments within SAM

Revenue Goals and Projections

Setting clear revenue goals based on projected market share and customer revenue allows companies to align business strategies with financial objectives. Establishing these projections requires continuous tracking of sales data, monitoring shifts within SAM, and adapting strategies to stay aligned with growth opportunities. In my experience, businesses that create data-backed revenue projections can set realistic goals that not only support growth but also allow for flexibility as market conditions change.

Focus Areas for Effective Revenue Planning:

- Define both short-term and long-term revenue targets

- Utilize historical data for trend analysis and forecasting

- Align marketing and sales efforts to meet financial objectives

For a deeper exploration into the structure of revenue projections within SAM, check out TAM, SAM, SOM article, which provides a comprehensive view of how these metrics contribute to market potential.

The Role of SAM in Investment Decisions

The Serviceable Addressable Market (SAM) is not only a cornerstone for market analysis but also a critical factor when making investment decisions. SAM helps businesses quantify market potential, aligning investor expectations with a realistic view of what the company can achieve. By focusing on a clearly defined segment of the market, companies can communicate a strategic approach that highlights both their strengths and their limitations, fostering investor confidence and clarifying resource allocation.

Communicating Value to Investors

When presenting SAM to potential investors, it’s essential to demonstrate the specific portion of the market the business can effectively serve. In my experience, providing data-backed insights into SAM helps convey a grounded view of market potential, making it easier for investors to understand where and how their resources will be utilized. A well-defined SAM showcases tangible growth opportunities, allowing investors to see the practical path toward revenue generation within the targeted segment.

Presenting SAM with precision also reinforces confidence in the business’s strategic direction. Rather than portraying overly ambitious goals based on Total Addressable Market (TAM), SAM gives a realistic perspective that investors can trust. A grounded SAM discussion not only attracts investment but also strengthens relationships with stakeholders by aligning the company’s projected impact with feasible outcomes.

Influence on Funding and Business Valuation

A well-defined SAM can significantly impact both funding discussions and business valuation. When SAM is accurately assessed, it signals to investors that the business has a solid grasp of its market potential and is prepared to capture revenue from a serviceable segment. This understanding often enhances business valuation, as investors appreciate the reduced risk associated with a realistic, data-informed market scope.

For example, when I guide entrepreneurs and students on crafting funding proposals, I advise them to articulate SAM clearly to enhance their leverage in negotiations. A focused SAM enables businesses to request capital appropriate to the opportunities within reach, ensuring that investment aligns with the growth trajectory. This clarity is reassuring for investors, as it highlights the scalability and profitability of the target market, thereby reinforcing trust in the company’s strategic vision for expansion.

Explore the full criteria venture capitalists consider when evaluating TAM in our comprehensive guide: How Do VCs Evaluate TAM

FAQs

what is a serviceable addressable market (SAM)

The Serviceable Addressable Market (SAM) is the portion of the Total Addressable Market (TAM) that a business can realistically target and serve with its current products, services, and resources. SAM reflects the specific market segments within TAM that align with a company’s operational capabilities and geographic reach.

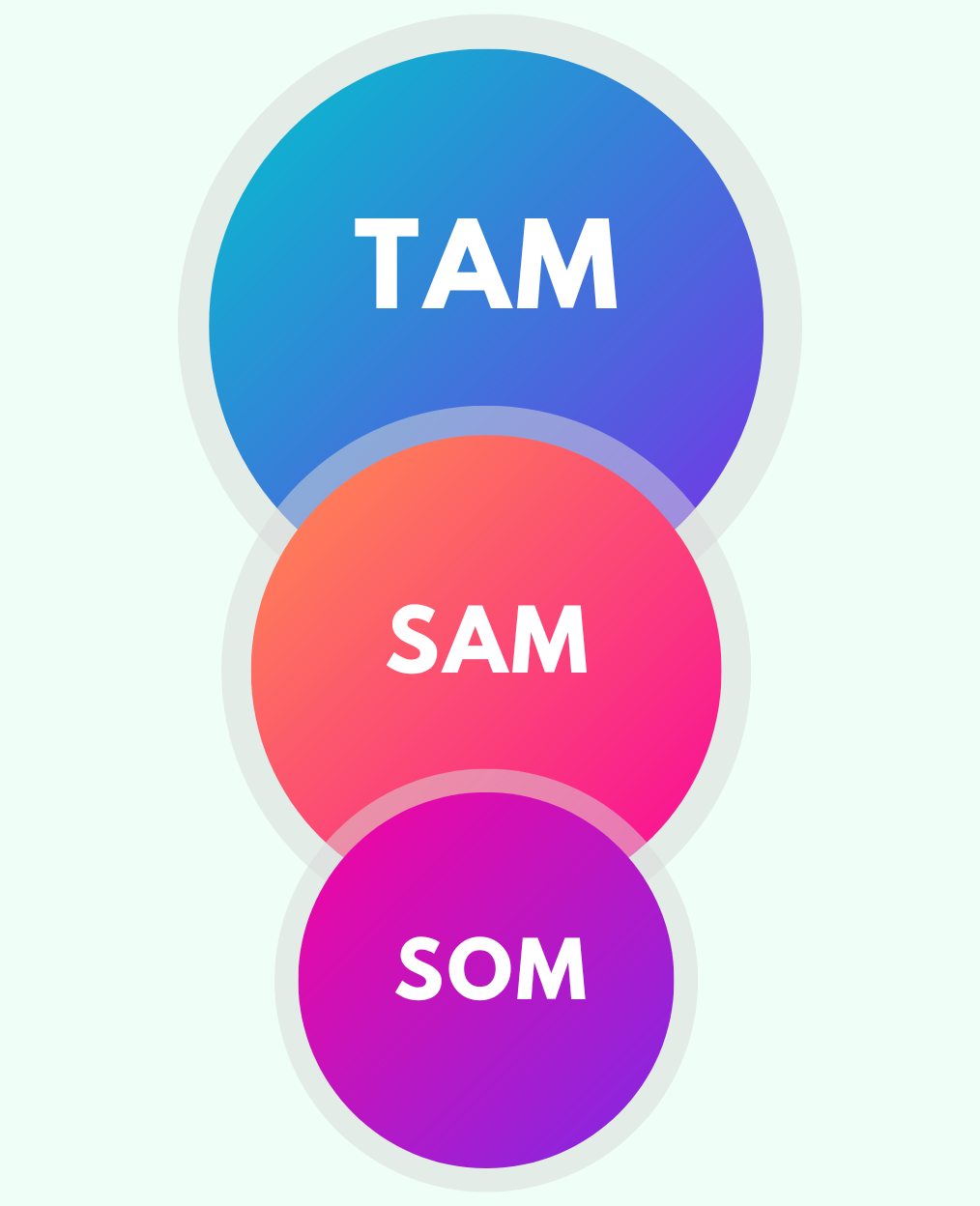

What is SAM vs. TAM vs. SOM?

TAM (Total Addressable Market) is the total revenue opportunity available if a product or service had 100% market share.

SAM (Serviceable Addressable Market) narrows TAM down to the portion the business can realistically target and serve based on current resources and limitations.

SOM (Serviceable Obtainable Market) is the share of SAM that a business expects to capture in the near term, considering competitive factors and internal limitations.

Check out our Market Sizing Cheat Sheet for straightforward tips and frameworks!

What is an example of SAM?

If a company makes eco-friendly packaging, the TAM might be the total global revenue from all packaging. The SAM could be the revenue from eco-friendly packaging in North America only, reflecting the company’s ability to serve that specific market.

A quick overview of the topics covered in this article.

Latest Posts

Subscribe to our newsletter

Get valuable insights and business guidance sent to your email.