In today’s competitive business landscape, understanding the size and potential of a market is essential for making strategic decisions.

One of the most critical metrics for this purpose is the Total Addressable Market (TAM) also called Total Accessible Market.

TAM represents the total revenue opportunity available for a product or service if it were to capture 100% of the market within a specific sector.

In essence, it answers the question: What is the maximum potential for this market?

TAM serves as a foundational measure for assessing whether a product or service has the potential to support substantial business growth. By providing an estimate of market size, it allows companies to make data-driven decisions about product development, expansion strategies, and resource allocation.

For startups looking to secure funding or companies planning to enter new markets, a clear understanding of TAM is crucial. Investors, too, consider TAM a valuable indicator when evaluating business models, as it reflects the scalability and overall growth potential within a target market.

As a business university professor, I frequently discuss TAM with students to help them appreciate its importance. Understanding TAM provides them with a roadmap for analyzing market potential, forecasting growth, and laying out realistic business goals.

Whether you’re a budding entrepreneur or a corporate strategist, knowing your Total Addressable Market is essential for aligning business plans with market realities.

This article will explore TAM in-depth, covering various methods of calculation, common pitfalls, and real-world examples to clarify its role in market entry and growth planning.

By the end, you’ll have the tools and knowledge to determine your own TAM accurately, setting your business on a path to strategic, informed decision-making.

Also, Explore our comprehensive guide TAM, SAM, and SOM

Key Takeaways

- TAM defines the total revenue opportunity for a product or service in a target market.

- Knowing your Total Addressable Market can guide decisions around growth, resource allocation, and market entry strategies.

- Understanding TAM’s limitations helps avoid missteps in market analysis and strategic planning.

- Key Takeaways

- Why Understanding Total Addressable Market (TAM) Matters

- Defining the Total Addressable Market

- What Does TAM Include?

- Methods for Calculating Total Addressable Market (TAM)

- 1. Top-Down Approach

- 2. Bottom-Up Approach

- 3. Value Theory Approach

- Step-by-Step Calculation Using a Practical Example

- Final Bottom-Up TAM Estimate

- Advantages of the Bottom-Up Approach

- Limitations of the Bottom-Up Approach

- Step-by-Step Calculation Using a Practical Example

- Final Value Theory TAM Estimate

- Advantages of the Value Theory Approach

- Limitations of the Value Theory Approach

- Does TAM consider paid user conversion ?

- Conclusion

- FAQs

Why Understanding Total Addressable Market (TAM) Matters

Total Addressable Market (TAM) is more than just a number; it’s a foundational metric that informs critical business strategies and investment decisions. By defining the full potential of a market, TAM allows businesses to assess the scope and scalability of their offerings. Understanding TAM guides decision-makers on where to invest resources, how to approach market entry, and which product innovations to pursue, aligning business growth plans with the broader market potential.

Whether you’re launching a startup, managing an established business, or analyzing an investment, TAM plays a crucial role in shaping informed strategies.

TAM’s Role in Strategic Decision-Making

In strategic planning, TAM provides an anchor for setting realistic growth targets and guiding resource allocation. Knowing the total revenue opportunity in a target market allows companies to prioritize initiatives and forecast long-term growth. For example, if a business discovers that its TAM for a specific product is limited, it may decide to pivot its offerings or focus on a more profitable market. Alternatively, a large TAM suggests ample room for growth, signaling that it could be worthwhile to commit significant resources toward capturing market share.

For those making entry decisions, such as whether to introduce a product or expand into a new region, TAM offers insights into the potential rewards. This can significantly impact market entry strategies and risk management, as TAM data helps outline the possible return on investment.

Key Benefits of TAM for Startups, Established Companies, and Investors

- Startups: For new companies, calculating Total Addressable Market is essential when building business models and attracting funding. A high TAM can make a startup more appealing to investors, who want to see growth potential that justifies their investment. Startups with a well-researched TAM can demonstrate that they understand their market and have a realistic growth path. Additionally, having a clear TAM helps startups decide how to allocate limited resources, such as whether to focus on product development, marketing, or customer acquisition.

- Established Companies: For larger, established firms, TAM supports strategic growth planning by providing data on new opportunities. When companies seek to enter new markets or diversify their offerings, TAM can validate these moves, ensuring they align with company goals and available resources. Additionally, for companies assessing whether a particular product line has reached its maximum potential, TAM offers a benchmark to evaluate if expansion into new segments or regions would be profitable. In this way, Total Addressable Market TAM serves as a map for sustaining long-term growth in competitive environments.

- Investors: Investors view Total Addressable Market as a critical factor in their evaluation process. A large TAM suggests that a business has room for expansion, making it more attractive as an investment. TAM indicates the scalability of a business model and its potential to generate high returns, which is especially important for venture capitalists and other early-stage investors. When considering a company for investment, TAM analysis gives investors a clearer picture of the upside potential, guiding them in making informed allocation decisions.

In sum, understanding TAM allows businesses and investors alike to align their strategies with market potential. Whether it’s refining a product, exploring new territories, or assessing the viability of an investment, TAM serves as a navigational tool, revealing where the most significant opportunities lie and how to reach them. This insight into the Total Accessible Market empowers companies to make data-driven decisions, optimizing their growth strategies and adapting proactively to market dynamics.

Defining the Total Addressable Market

At its core, TAM captures the upper revenue limit if a company could secure every potential customer in a market. This understanding helps set goals, refine product development strategies, and guide companies as they expand into new segments. To help my students grasp this, I sometimes use a total addressable market calculator as a hands-on example, allowing them to see how different factors impact TAM estimates.

Investors consider a company’s Total Addressable Market a fundamental part of due diligence. A sizable TAM signals substantial growth potential, making the company attractive for investment. Investors also use TAM Total Addressable Market data to understand the potential scalability of a business model, assessing whether it has room for growth within its target market. This insight is invaluable for strategic growth planning, as it helps determine the viability of geographic expansion or new market entry.

For more on how market research influences these investment decisions, check out our guide on market research fundamentals.

What Does TAM Include?

TAM, or Total Addressable Market, includes the total revenue opportunity available for a product or service if it captures 100% of the market share. It represents the overall demand for a solution within a specific industry or sector. TAM typically factors in:

- Market Size: The total number of potential buyers or users.

- Average Revenue per User (ARPU): How much each customer is willing to spend.

- Geographical Scope: Regional, national, or global reach of the product or service.

By understanding TAM, businesses can gauge the potential scale of an opportunity before entering the market.

Methods for Calculating Total Addressable Market (TAM)

Accurately calculating the Total Addressable Market (TAM) is essential for understanding market potential, supporting strategic decision-making, and informing resource allocation. Three primary methods are widely used to determine TAM: the Top-Down, Bottom-Up, and Value Theory approaches. Each approach offers unique insights and varies in complexity, depending on the available data and the specificity of the target market.

1. Top-Down Approach

The Top-Down approach to calculating Total Addressable Market (TAM) begins with broad market data and gradually narrows it down to reflect the specific market segment a company intends to serve. This method relies on secondary data sources, such as industry reports, government statistics, or published market research, to determine the total market size and then applies filters to focus on the relevant segments.

The Top-Down approach is particularly effective for companies entering well-established markets, where data on customer demographics, product demand, and industry revenue is widely available.

Step-by-Step Calculation Using a Practical Example

Imagine a company developing a project management tool targeting medium-sized businesses in North America. The company wants to determine its Total Addressable Market TAM using the Top-Down approach.

Identify the Broad Market Size:

Start with the broadest possible market size relevant to the industry. Here, the company would look at the entire global project management software market. According to industry reports, the global market for project management software is valued at $10 billion annually.

Apply Geographic Filter:

Since the company is only targeting businesses in North America, the next step is to narrow down the market to this region. Suppose North America accounts for 40% of the global market size for project management software. Therefore:

Apply Company Size Filter:

The company only targets medium-sized businesses, which represent 30% of the North American market for project management tools. Thus:

Apply Additional Product-Specific Filters (Optional):

If the project management tool offers unique features that may appeal to specific industries or workflows, the company might further refine its market estimate. Let’s assume 50% of medium-sized businesses in North America require advanced features (like AI-powered task automation) that this tool offers. Applying this filter:

Final Top-Down TAM Estimate:

After applying these filters, the Total Addressable Market for the company’s project management tool targeting medium-sized businesses in North America is estimated at $600 million annually. This figure represents the maximum revenue opportunity if the company captured 100% of this market.

Advantages of the Top-Down Approach

- Simplicity and Efficiency: The Top-Down approach leverages readily available data, making it faster and more straightforward, especially in mature markets with comprehensive market reports.

- Quick Validation: For new product ideas, the Top-Down approach can quickly indicate if there is a substantial market, providing a high-level perspective that helps in early-stage planning.

Limitations of the Top-Down Approach

- Potential Lack of Precision: Because it relies on general industry data, the Top-Down approach may not be highly accurate for niche products or innovative solutions. In the example above, the company’s TAM may still be overestimated, as some medium-sized businesses might not be actively looking to switch project management tools.

- Dependence on Published Data: This method is limited by the granularity of the data available. If market reports don’t capture detailed information about specific demographics, it can lead to overgeneralized conclusions.

2. Bottom-Up Approach

The Bottom-Up approach builds the Total Addressable Market by focusing on specific data points gathered from the target audience. This method is highly data-driven and generally more precise, as it relies on actual customer or business data (e.g., unit prices, customer counts, or subscription fees). By estimating the TAM from the ground up, companies get a granular view of their revenue potential within a specific segment.

The Bottom-Up approach is particularly beneficial for niche markets or highly targeted customer bases where detailed internal data is available.

3. Value Theory Approach

Step-by-Step Calculation Using a Practical Example

Consider a B2B software company that provides HR management solutions tailored for small businesses in the United States. The company wants to determine its Total Addressable Market TAM using the Bottom-Up approach.

Identify the Total Number of Potential Customers:

Start by determining how many businesses fit the target market criteria. According to available market research, there are approximately 500,000 small businesses in the U.S. that fall within the target demographic for HR management solutions (businesses with 10–50 employees needing HR software).

Calculate Average Revenue per Customer:

The company offers subscription-based HR software at a monthly rate of $100 per business, which amounts to $1,200 annually per customer.

Multiply the Total Number of Customers by the Annual Revenue per Customer:

With these inputs, the company can calculate the TAM by multiplying the total number of potential customers by the average annual revenue per customer:

Final Bottom-Up TAM Estimate

Using this approach, the company’s Total Addressable Market for its HR software targeting small businesses in the U.S. is $600 million annually. This TAM estimate assumes 100% market penetration—meaning the company captures every potential customer.

Advantages of the Bottom-Up Approach

- Higher Accuracy: This approach is often more accurate as it is based on specific, real-world data, particularly effective for targeted markets with well-defined customer segments.

- Customizable Based on Market Nuances: By using actual customer data, companies can factor in detailed elements like seasonal demand, average contract values, or varying price tiers, resulting in a more precise TAM calculation.

Limitations of the Bottom-Up Approach

- Data-Intensive: Gathering the necessary data for a Bottom-Up analysis can be resource-intensive, especially for startups or businesses without substantial market data.

In scenarios where customer segmentation and product fit are crucial, the Bottom-Up approach provides a refined TAM estimate that can guide strategic growth planning. For more insights on how to leverage strategic market research, see our article on How is Strategic Market Research Used

The Value Theory approach to calculating Total Addressable Market (TAM) focuses on the potential value a product or service delivers to customers. This method differs from other approaches by estimating the maximum price customers would be willing to pay based on the value the product provides rather than current market size or number of customers. In this way, it allows companies to quantify TAM based on the unique value or cost savings a solution offers.

This approach is particularly useful for new, innovative products where traditional market data may not yet be available, and for products or services that address specific pain points or efficiency improvements for customers.

Step-by-Step Calculation Using a Practical Example

Imagine a company that has developed a productivity software tool that automates repetitive tasks for medium-sized companies, aiming to save each business around 1,000 hours of labor per year. The company wants to calculate its Total Addressable Market TAM using the Value Theory approach.

Determine the Average Cost Savings for Customers:

First, estimate the value the product provides. In this example, medium-sized companies estimate that an hour of labor costs approximately $50. Thus, the software tool offers a potential savings of:

Estimate the Maximum Price Customers Would Pay:

Based on the savings generated, companies may be willing to pay a portion of these savings for the product. To remain attractive, the company decides to price the software at 10% of the annual savings, which equates to:

Identify the Total Number of Potential Customers:

After pricing is established, determine the potential customer base. Assume there are approximately 100,000 medium-sized companies in the target market that could benefit from productivity automation.

Calculate TAM by Multiplying the Total Number of Customers by the Annual Price per Customer:

The TAM is calculated by multiplying the potential number of customers by the price each customer would pay:

Final Value Theory TAM Estimate

Using the Value Theory approach, the Total Addressable Market for the productivity software tool is $500 million annually. This estimate is based on the assumption that all potential customers recognize the value of the software and are willing to invest in it.

Advantages of the Value Theory Approach

- Insight into Pricing Strategy: The Value Theory approach helps identify optimal pricing based on the value customers gain, guiding companies in setting prices that reflect the tangible benefits to customers.

Limitations of the Value Theory Approach

- Reliance on Assumptions: The Value Theory approach depends heavily on assumptions about customer willingness to pay and estimated cost savings, which can be subjective. Without validation, these assumptions may not hold true across the customer base.

- Market Testing Required: For new products, it may be necessary to conduct market testing or pilot programs to confirm that customers are willing to pay the estimated price, making this approach more complex and time-consuming.

The Value Theory approach can be particularly insightful when combined with other TAM calculation methods to validate assumptions and identify any gaps. For businesses focusing on customer pain points and value-driven pricing, this approach helps capture the total market potential more effectively.

For more information on answering common questions around TAM and market calculations, take a look at our article on Market Research FAQs

Does TAM consider paid user conversion ?

The Total Addressable Market (TAM) calculation traditionally represents the maximum revenue potential of a market and is based on the entire market demand for a product or service if it achieved 100% market penetration. TAM generally does not directly factor in specific conversion rates (e.g., from free to paid users) or assume any level of customer conversion because it’s designed to reflect an upper-limit market estimate, regardless of real-world barriers like competition, customer adoption rates, or budget constraints.

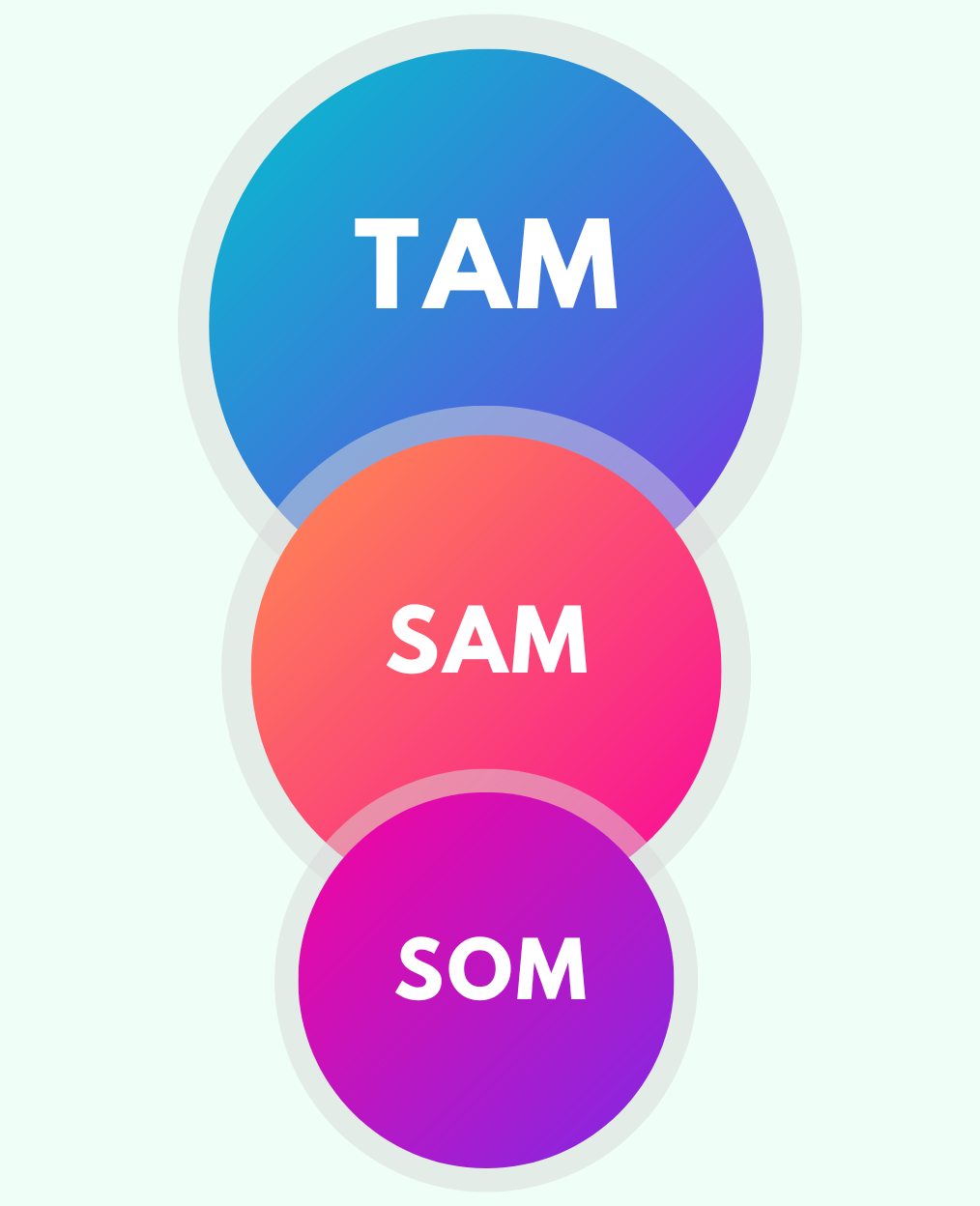

When refining TAM for practical applications, such as understanding a realistic portion of the market that may convert to paid users, companies typically use Serviceable Addressable Market (SAM) and Serviceable Obtainable Market (SOM):

- SAM adjusts TAM by including only the portion of the market that can realistically be served based on the company’s current business model, target audience, and geographic reach.

If the goal is to determine potential revenue from paid users specifically, SAM or SOM can be used to factor in conversion likelihood and target market characteristics.

This approach provides a realistic view of revenue potential based on attainable user conversion rates rather than the broader TAM figure.

Conclusion

Understanding your Total Addressable Market (TAM) is a crucial step in building a strategic roadmap for growth. By calculating TAM, businesses can gain valuable insights into the revenue potential of a market, helping to align product development, marketing, and expansion strategies with actual demand. Whether you’re a startup validating a new idea, an established company exploring new markets, or an investor assessing growth potential, TAM serves as a foundational tool for informed decision-making.

In this article, we explored three primary methods to calculate Total Addressable Market: the Top-Down, Bottom-Up, and Value Theory approaches. Each method provides unique insights:

- The Top-Down approach is ideal for well-established markets, using broad industry data to narrow down to relevant segments.

- The Bottom-Up approach relies on actual customer data, allowing for greater precision, especially in niche markets or where data is readily available.

- The Value Theory approach focuses on the unique value a product delivers, useful for innovative offerings without established market data.

While TAM offers a high-level view of market potential, it is important to remember that TAM alone does not guarantee success. It should be used alongside other key metrics, such as SAM (Serviceable Addressable Market) and SOM (Serviceable Obtainable Market), for a realistic, actionable perspective. Regularly reassessing your TAM in light of shifting market conditions, emerging competitors, and evolving customer needs will ensure your strategy stays aligned with the latest market dynamics.

For entrepreneurs, the first step is to gather accurate data, choose a calculation approach suited to your goals, and validate estimates through market research. For established businesses, TAM can guide strategic decisions like market entry and product expansion, helping to allocate resources where they will have the greatest impact. And for investors, TAM is a lens into a company’s growth potential, shedding light on scalability and the likelihood of long-term returns.

Learn more about the criteria venture capitalists apply in evaluating TAM in our detailed guide: How Do VCs Evaluate TAM

Ultimately, TAM is more than a number; it’s a roadmap for navigating the market landscape, identifying opportunities, and strategically positioning your business for sustainable growth. By combining a comprehensive understanding of Total Addressable Market TAM with agile, data-driven strategies, companies can achieve impactful growth and make informed decisions that lead to long-term success.

For ongoing insights into market trends and strategic planning, be sure to explore our resources, such as Market Research Trends and Benefits of Market Research.

FAQs

What does TAM stand for in business ?

In business, TAM stands for Total Addressable Market. This metric represents the total revenue opportunity available for a product or service if it were to achieve 100% market share in its target segment. TAM helps companies and investors assess the potential scale and profitability of a business opportunity, guiding decisions around resource allocation, product development, and market entry strategies.

How to measure TAM size ?

To measure Total Addressable Market (TAM) size:

1. Top-Down: Start with the overall market size and narrow it to your target segment using filters like region or industry.

2. Bottom-Up: Multiply the number of potential customers by the average revenue per customer.

3. Value Theory: Estimate TAM based on the value your product provides to customers and what they’d pay for that benefit.

Each method gives a different angle on market potential, often combined for accuracy.

What percentage of the tam converts to paid users?

Typically, the percentage of Total Addressable Market (TAM) that converts to paid users varies significantly based on factors like industry, competition, pricing, and product appeal. For most businesses, only a fraction of the TAM converts to actual paid users, often ranging from 1% to 10% initially.

This percentage can grow over time as brand recognition, customer acquisition strategies, and market penetration increase. Using more specific metrics, like SAM (Serviceable Addressable Market) and SOM (Serviceable Obtainable Market), provides a clearer and more realistic estimate of the potential paying user base.

What Is the Difference Between TAM and Market Size?

While TAM highlights the ceiling of opportunity, market size focuses on the ground reality of customer behavior and market trends.

TAM: Refers to the theoretical revenue opportunity if a company captured the entire market.

Market Size: Reflects the current or projected value of the market, often adjusted for competition, customer adoption, and other real-world factors.

What Are TAM Metrics?

TAM metrics are the specific data points and calculations used to determine the total addressable market. These include:

Customer Count: Number of potential buyers in the market.

Spending Patterns: How much customers typically spend on similar products.

Market Growth Rates: Projections for future expansion.

Revenue Potential: Annual revenue achievable if the entire market is captured.

TAM metrics provide actionable insights to help businesses assess feasibility and strategize for growth.

Check out our Market Sizing Cheat Sheet for straightforward tips and frameworks!

A quick overview of the topics covered in this article.

Latest Posts

Subscribe to our newsletter

Get valuable insights and business guidance sent to your email.