Understanding How to Do Market Sizing is crucial for B2B tech companies. They need to identify growth opportunities and make informed decisions.

By calculating the total addressable market (TAM) and serviceable addressable market (SAM), businesses can better assess their potential and strategize accordingly.

This process involves specific approaches and models to analyze market demand, segment different audiences, and evaluate competitive landscapes.

Effective market research is the backbone of this analysis. Companies must gather accurate data and insights to estimate their market potential, evaluate financial aspects, and ensure that their product development aligns with market needs.

Each choice made during this process can significantly impact the company’s strategic direction and success in a fast-evolving tech landscape.

To remain competitive, B2B tech companies should continuously monitor market dynamics and adapt their strategies as needed. This adaptability enhances their ability to provide value and meet customer needs while staying ahead of competitors.

Key Takeaways:

- B2B tech companies need to calculate their total addressable market for informed strategy.

- Accurate data collection and analysis drive effective market sizing.

- Monitoring market dynamics helps businesses adapt and remain competitive.

- Understanding the Basics of Market Sizing

- Market Sizing Approaches and Models

- Identifying B2B Market Segments

- Data Collection and Analysis

- Competitive and Comparative Market Analysis

- Estimating Market Potential

- Financial Aspects of Market Sizing

- Incorporating Business and Marketing Strategies

- Product Development and Market Fit

- Monitoring and Responding to Market Dynamics

- Frequently Asked Questions

Understanding the Basics of Market Sizing

Market sizing identifies the potential revenue and market opportunity for a business. It utilizes specific metrics to clarify different market segments and their sizes, guiding companies in decision-making.

Defining Market Sizing Concepts

Market sizing is the process of estimating the total revenue potential of a given market or segment. This involves considering factors like customer needs, competition, and overall industry trends.

Companies in the B2B tech sector often seek to understand how big a market can be before entering.

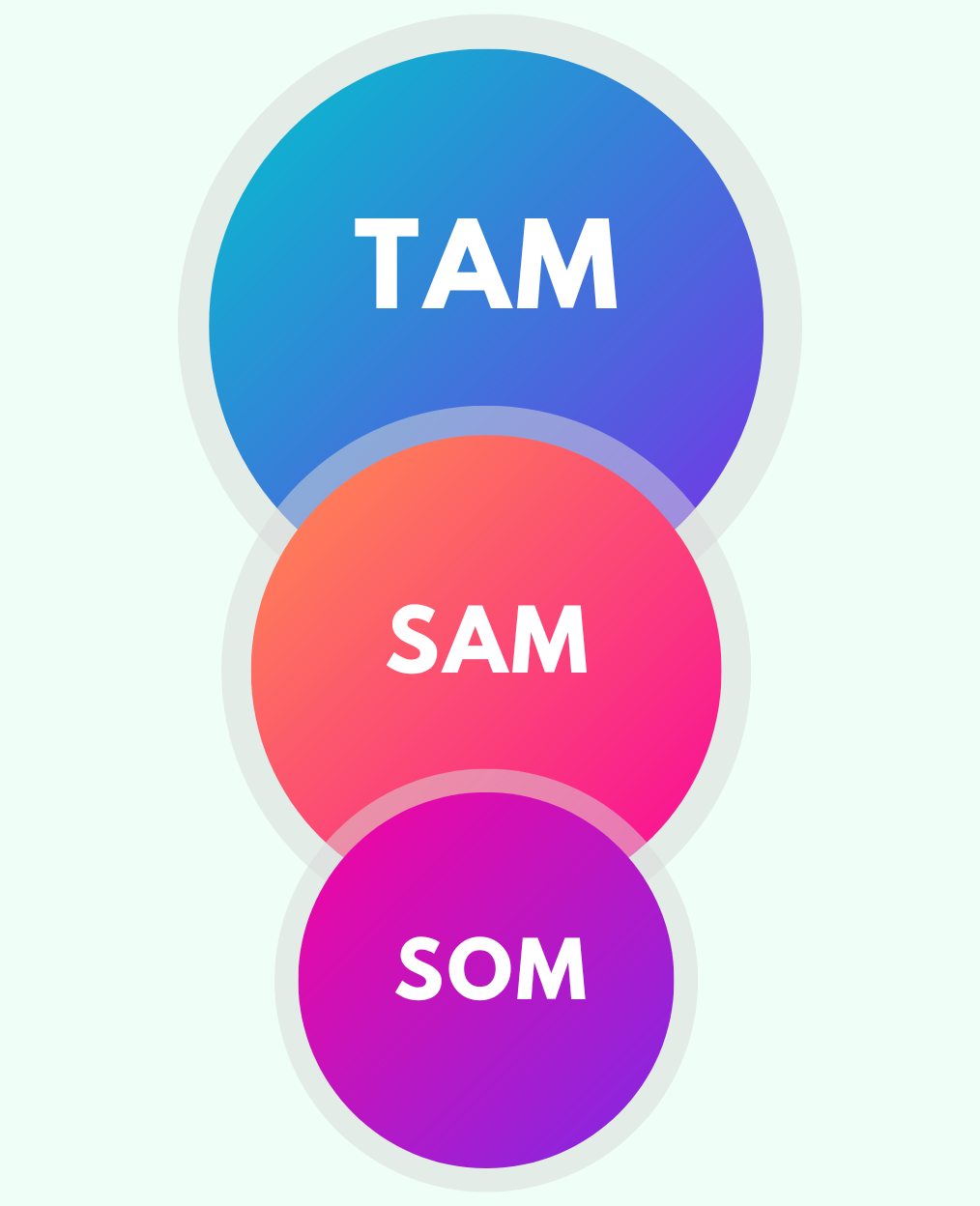

Three critical concepts in market sizing are Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM)

TAM represents the total revenue opportunity for a product or service, encompassing all potential customers. SAM narrows down this estimate by focusing on the segment that can be served based on a company’s business model. Meanwhile, SOM further refines this figure, indicating the portion of the market that a company can realistically capture.

For a deeper look into these metrics, understanding TAM, SAM, and SOM is essential.

Importance of TAM, SAM, and SOM

Knowing TAM, SAM, and SOM is crucial for B2B tech companies. These metrics offer insights into market potential and help with strategic planning.

TAM helps companies understand how much they can earn if they capture 100% of the market. Meanwhile, SAM narrows down this estimate by focusing on the segment that can be served based on a company’s business model.

SOM provides a realistic target, helping businesses set achievable revenue goals. Understanding the nuances between these metrics can lead to better strategic decisions and resource allocation.

For instance, learning how to calculate Total Addressable Market aids in making informed investment choices and setting business priorities.

Market Sizing Approaches and Models

Market sizing for B2B tech companies can be tackled using several approaches. Each approach has its strengths and considerations, depending on the specific needs and available data.

Top-Down Approach

The top-down approach uses existing market data to estimate market size. Analysts begin with a broad understanding of the entire market and then narrow it down to the particular segment relevant to their business.

This method often uses industry reports and databases to gain insights. Analysts might look at overall market revenues and apply a percentage for their specific niche.

Tools like Gartner and Forrester provide valuable resources for gathering data. This approach is typically faster but may lack precision due to reliance on estimations.

Bottom-Up Approach

The bottom-up approach, on the other hand, focuses on detailed, specific data about customers and sales. Companies begin by calculating their own sales or potential sales based on the number of expected customers.

By gathering data from current customer insights and market research tools, they can build a more accurate estimate. Techniques such as surveys or interviews help in understanding customer needs and spending potential.

This method usually results in more reliable forecasts. However, it can be time-consuming and may require access to comprehensive data sources.

Hybrid Approach

The hybrid approach combines aspects of both top-down and bottom-up methods. It leverages broader market insights while also considering specific internal data.

This approach can refine estimates and enhance accuracy.

Using a mixture of market research tools and available data, analysts can create a more rounded view of the market landscape. They can validate findings from one method against the other.

This flexibility allows for adjustments based on new information or changing market conditions. It balances the speed of top-down with the detail of bottom-up, making it useful for B2B tech companies seeking a nuanced understanding of their market size.

Identifying B2B Market Segments

Identifying the right market segments is crucial for B2B tech companies. This process involves categorizing market verticals and creating a detailed ideal customer profile (ICP) to enhance targeting and sales strategies.

Categorizing Market Verticals

Market verticals refer to specific industry sectors where companies operate. To effectively categorize these, firms should analyze the following criteria:

- Industry Type: Identify the industries that align with the company’s products or services, such as finance, healthcare, or technology.

- Company Size: Consider the size of potential customers, including small, medium, and large enterprises. Each segment may have different needs and purchasing power.

- Geographic Location: Determine if the business targets local, national, or global markets. This can influence marketing strategies and sales approaches.

By categorizing market verticals, companies can narrow down their target market. This helps in customizing messaging and product offerings to meet the unique demands of each segment.

Creating an Ideal Customer Profile

An ideal customer profile (ICP) is a detailed description of the type of company that would benefit most from a firm’s products. To create an effective ICP, consider the following aspects:

- Firmographics: Include data such as industry, company size, and revenue. These factors help in defining the target market.

- Behavioral Traits: Identify characteristics of existing customers who see the most value. This includes purchase behavior and engagement patterns.

- Pain Points: Analyze common challenges faced by potential customers. Understanding these issues can help tailor solutions.

Developing a strong ICP guides marketing efforts and improves sales productivity. It allows B2B tech companies to focus on customer segments most likely to convert.

Data Collection and Analysis

Effective data collection and analysis are critical for B2B tech companies to understand their market. This involves gathering information through various methods and tools tailored to specific business needs.

Strategies such as primary market research, utilizing market research tools, and leveraging industry reports provide valuable insights for informed decision-making.

Primary Market Research

Primary market research involves the collection of firsthand data tailored to a company’s specific goals. This can include customer surveys and focus groups.

Surveys gather quantitative insights, while focus groups provide qualitative feedback through discussions.

When designing surveys, it is important to ask clear and relevant questions. This ensures that the data collected accurately reflects customer opinions and preferences.

Focus groups allow companies to dive deeper into customer thoughts and behaviors, providing context behind the numbers.

Tech companies should consider leveraging platforms like Typeform or SurveyMonkey for online surveys. Focus groups can be organized in person or virtually, depending on resources and audience reach.

For a deeper understanding of the distinctions between primary research vs secondary research, visit our comprehensive guide.

Utilizing Market Research Tools

Utilizing specific market research tools can enhance data collection efficiency. Tools like Gartner and Forrester provide pre-analyzed data that can inform strategies.

These platforms offer insights on industry trends, competitor landscapes, and customer preferences.

B2B companies should use these resources to track critical metrics. Combining insights from different tools helps build a comprehensive market view.

For example, integrating data from tools like IBISWorld offers a detailed industry analysis alongside competitor data.

Selecting the right tools is essential. Companies may also find value in using specialized tools focused on specific data needs, such as website traffic or customer behavior forecasts.

Leveraging Industry Reports

Industry reports are valuable for understanding broader market trends and benchmarks. Reports from organizations like Gartner and Forrester provide insights that are specifically useful for B2B tech companies.

These reports often include data on market size, growth rates, and competitive landscape. They help companies identify opportunities and threats within their sectors.

When reviewing industry reports, companies should focus on relevant metrics that align with their strategic goals. This data aids in effective market sizing and forecasting.

Regularly consulting these reports ensures that a company stays informed on industry shifts, allowing for quick adjustments to their strategies.

Competitive and Comparative Market Analysis

Competitive and comparative market analysis is essential for B2B tech companies to understand their position in the market. This analysis includes assessing competitors and their strategies, as well as determining how a company’s offerings stack up against others in the industry.

Assessing the Competitive Landscape

To assess the competitive landscape, companies need to identify both direct and indirect competitors. This includes understanding their products, services, and market share.

Key steps include:

- Gathering Data: Use tools and resources to collect information on competitors, such as pricing, features, and customer reviews.

- Analyzing Strengths and Weaknesses: Evaluate what competitors do well and where they fall short. This helps identify potential opportunities for differentiation.

- Market Positioning: Map out where competitors stand in the market based on criteria like size, revenue, and focus.

This analysis aids in recognizing market trends and predicting competitor behavior.

Understanding Competitive Positioning

Competitive positioning involves determining how a company’s product or service stands relative to its competitors. It requires a deep understanding of market needs and customer preferences.

Companies should focus on:

- Unique Value Proposition: Identify what makes their offering unique. This could be technology, customer service, or pricing strategies.

- Customer Segmentation: Define target customers and understand their specific needs. Matching these needs with product features can create a competitive advantage.

- Pricing Strategies: Analyze competitor pricing to ensure offerings are competitive but also profitable.

Effectively positioning a product can lead to gaining market share and establishing brand loyalty.

Estimating Market Potential

Understanding market potential is essential for B2B tech companies to seize opportunities. Proper estimation involves calculating both the Serviceable Available Market (SAM) and the expected share of that market. These factors help in making informed business decisions.

Calculating Serviceable Available Market

The Serviceable Available Market (SAM) is the segment within the Total Addressable Market (TAM) that a company can target. To calculate SAM, a business must consider its product offerings and geographical reach.

- Identify Target Customers: Focus on the specific businesses that could benefit from the product.

- Research Market Data: Use industry reports, surveys, and sales data to determine how much of the market they can realistically capture.

Once defined, estimating the SAM helps in mapping out sales value more accurately.

Determining Expected Share

Expected share refers to the percentage of the SAM that a company can realistically achieve. This requires a thoughtful analysis of several factors, including competition, market trends, and company strengths.

- Assess internal capabilities: Companies should analyze their resources, such as sales teams and technology, to support sales targets.

Financial Aspects of Market Sizing

Understanding the financial aspects of market sizing is crucial for B2B tech companies.

This involves analyzing revenue forecasting and its impact on investment decisions to make informed strategic choices.

Revenue Forecasting

Revenue forecasting is essential for B2B tech companies to estimate future income.

Accurate forecasts depend on understanding market size, potential customer base, and pricing strategy.

By evaluating historical data from financial reports, companies can identify trends that help predict sales growth.

A few key steps in revenue forecasting include:

- Identifying Target Market: Define the specific segments that the company aims to serve.

- Setting Pricing Strategy: Establish competitive pricing while considering customer willingness to pay.

- Estimating Sales Volume: Calculate expected unit sales based on market size.

Effective forecasting not only provides insight into potential revenue but also motivates a proactive approach to meet anticipated demand.

This analysis guides businesses in prioritizing their financial goals and aligning resources effectively.

Influence on Investment Decisions

Investment decisions are greatly influenced by the results of market sizing.

Knowledge of total addressable market (TAM) helps stakeholders understand the growth potential of the business.

Investors often look for strong revenue potential as an indicator of future success.

Key considerations include:

- Evaluating Financial Reports: Analyzing financial documents to assess past performance and future outlook.

- Resource Allocation: Companies can prioritize initiatives that show the most promise for growth.

- Guiding VC Evaluation: Understanding how VCs evaluate TAM helps firms position themselves favorably for funding opportunities.

By employing robust market sizing techniques, B2B tech companies can drive smarter investment decisions and enhance their growth strategies.

This approach can solidify their standing in competitive markets, ensuring that resources are focused on the most lucrative areas.

Incorporating Business and Marketing Strategies

A strong market sizing approach for B2B tech companies involves aligning with their business model and developing effective marketing strategies.

These components are essential for achieving market penetration and maximizing success.

Aligning with Business Model

Understanding the business model is crucial. A B2B tech company often depends on factors such as subscription-based revenue, one-time sales, or freemium models.

Each model influences how they size the market.

For example, companies using a subscription model should consider the total addressable market (TAM) based on annual recurring revenue (ARR).

This requires analyzing the average contract value and potential customer base.

In contrast, a one-time sales model focuses on total units that can be sold.

Focusing on distribution channels is also vital. This includes direct sales, partnerships, and online platforms.

Aligning market size estimates with the chosen business model increases the chance of successful strategy implementation.

Developing Effective Marketing Strategies

Once the business model is understood, companies must craft targeted marketing strategies.

Account-based marketing (ABM) is especially useful in B2B markets.

This approach tailors marketing efforts to individual high-value accounts, enhancing engagement and conversion rates.

Identifying specific buyer personas is key. Companies should segment their audience based on industry, company size, and needs.

This ensures marketing messages resonate with each target group.

Utilizing different distribution channels effectively is also important.

Companies should leverage email campaigns, social media, and webinars to reach potential clients.

Each channel must be aligned with the overall marketing strategy to optimize market penetration efforts.

Product Development and Market Fit

Product development plays a critical role in achieving market fit.

Understanding customer needs and incorporating data can guide product evolution and launch strategies.

Matching Products to Market Needs

Identifying the right product for the target market is essential.

Companies should start by conducting thorough market research. This includes analyzing competitors, customer demographics, and industry trends.

Surveys and focus groups can provide direct feedback on customer preferences. A well-defined value proposition will help align the product with market demands.

Once the product concept is established, prototypes should be developed. This allows for testing and gathering user feedback, which can shape final adjustments before a wider product launch.

Iteration is vital; continuous improvements based on real user experiences enhance market fit.

Role of Customer Data in Product Evolution

Customer data is a valuable asset in refining products. It provides insights into usage patterns, preferences, and pain points.

By collecting quantitative and qualitative data, companies can make informed decisions.

Analyzing this data helps in identifying feature requests and potential market gaps.

Regularly analyzing customer feedback through reviews and support channels helps in making timely adjustments.

Additionally, leveraging analytics tools can track engagement and predict future trends.

Incorporating data-driven insights into product development processes enables companies to stay relevant and meet evolving customer needs.

Adapting products based on ongoing data analysis significantly boosts chances of successful market fit.

Monitoring and Responding to Market Dynamics

Staying informed about market dynamics is crucial for B2B tech companies.

Companies must be flexible and make data-driven decisions to thrive.

The sections below focus on adapting to industry trends and using data effectively for strategic planning.

Adapting to Industry Trends

To remain competitive, firms must keep a close eye on industry trends.

This involves regularly analyzing market data and customer feedback.

Key actions include:

- Conducting regular market research: Firms should utilize tools that help analyze shifts in customer preferences and competitor movements.

- Engaging with industry reports: Utilizing reports from credible sources can provide insights on emerging technologies and shifts in buyer behavior.

By identifying trends early, companies can adjust their offerings or marketing strategies.

This proactive approach allows for better alignment with customer needs and market demands, increasing the chance of success.

Data-Driven Decisions for Strategic Planning

Data-driven decisions form the backbone of effective strategic planning.

Companies should gather and analyze data from various sources to guide their plans.

Effective steps include:

- Leveraging analytics tools: Tools can help convert raw data into meaningful insights, identifying growth opportunities and areas for improvement.

- Tracking KPIs: Companies need to monitor key performance indicators to understand their market position and customer engagement levels.

Regular reviews of data enable firms to pivot quickly in response to market changes.

By anticipating shifts in market dynamics, businesses can create strategies that are not only reactive but also proactive, securing a competitive edge.

Frequently Asked Questions

This section addresses common inquiries regarding how to do market sizing for B2B tech companies.

How to calculate B2B market size?

Estimate the total addressable market (TAM) by analyzing industry data, calculate the serviceable addressable market (SAM) based on target segments, and refine to the serviceable obtainable market (SOM) using internal capabilities and competitive insights.

How do you market a B2B tech company?

Focus on targeted marketing, such as account-based marketing (ABM), emphasizing value propositions, industry-specific solutions, and nurturing leads through tailored content and direct engagement.

What are the 5 strategies that will determine the market size?

Combine TAM, SAM, SOM analysis, customer segmentation, market research, competitive analysis, and validation using top-down or bottom-up approaches.

What tools and software solutions are recommended for facilitating accurate market sizing in the tech industry?

Recommended tools for market sizing include Excel for data analysis. You should also consider specialized market research agencies like Statista and IBISWorld, as well as CRM platforms for customer insights. Using these tools can streamline the process and enhance the accuracy of market size estimates for tech companies.

Check out our Market Sizing Cheat Sheet for some straightforward tips and frameworks!

A quick overview of the topics covered in this article.

Latest Posts

Subscribe to our newsletter

Get valuable insights and business guidance sent to your email.