For venture capitalists, Total Addressable Market (TAM) is key when evaluating a startup. TAM shows the total revenue a product or service could bring if it captured its entire target market. A large TAM signals growth potential, which appeals to investors.

I’m Dr. Loaloa Riad, a business university lecturer with a PhD in strategic management and co-founder of Globemonitor, a market research agency.

In my work, I’ve seen that a well-calculated TAM can strongly impact a startup’s chances of securing funding. Investors look for founders who understand their market’s size, possible demand, and competitive landscape. A clear, accurate TAM shows ambition and helps build investor confidence.

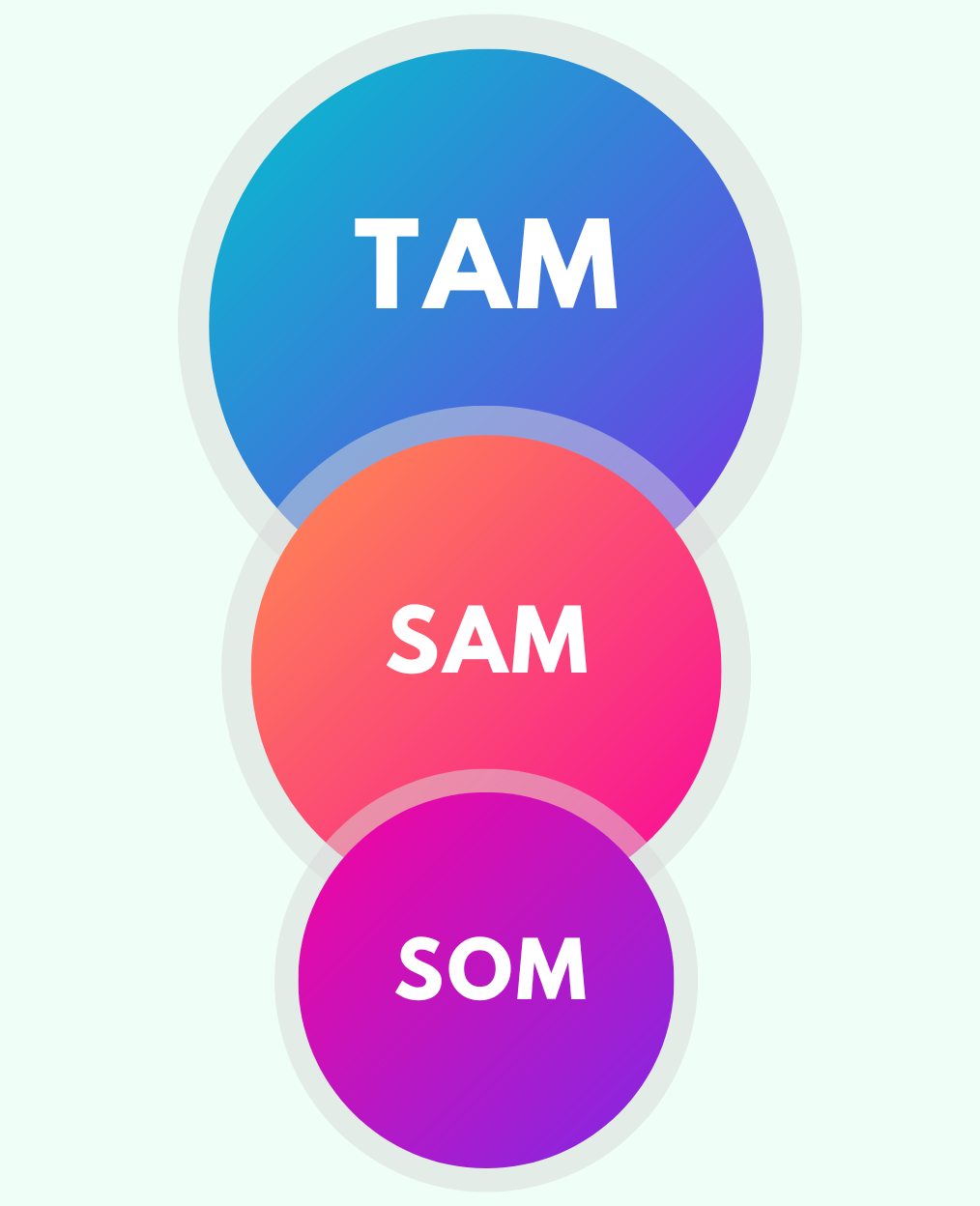

It’s important to distinguish TAM from related concepts like SAM (Serviceable Addressable Market) and SOM (Serviceable Obtainable Market).

While TAM measures total market size, SAM and SOM help define the more specific customer base.

For more insights, see our guide on TAM, SAM, SOM

This article explains how do VCs evaluate TAM for startups, the methods they use, and why TAM accuracy matters. Knowing this can give startups a better shot at investment.

Key Takeaways

- VCs evaluate TAM to gauge potential market growth.

- Effective execution and market strategy influence VC decisions.

- Market dynamics and positioning affect startup evaluations.

VCs’ Perspective on Evaluating TAM

VCs see a TAM of over $1 billion as a strong indicator of market opportunity, especially in industries like tech and healthcare where scalability is essential. While market size is important, VCs are equally interested in a startup’s realistic strategy to capture a portion of the TAM.

In the evaluation process, VCs assess a company’s business model, team capabilities, and execution strategy. The startup’s go-to-market plans, customer traction, and unique market positioning also play a critical role.

VCs differentiate between TAM (Total Addressable Market), SAM (Serviceable Addressable Market), and SOM (Serviceable Obtainable Market). They use TAM to understand the broadest potential, but SAM and SOM provide a closer look at the startup’s realistic, reachable market.

In short: VCs evaluate TAM for its size and, critically, for its accuracy. A realistic, data-backed TAM can greatly improve a startup’s appeal to investors by showing both ambition and grounded planning.

How do VCs valuate TAM of a startup

Venture capitalists rely on three main approaches to assess a startup’s TAM: the top-down approach, the bottom-up approach, and the value-theory approach. Each approach gives VCs a clearer view of market potential and helps them decide if a startup has the reach they’re looking for. Here’s a closer look at each method:

- Top-Down Approach: In the top-down approach, VCs start with broad industry data, often from market research reports. They look at overall industry size and use this to estimate TAM. This approach is quick and can give a rough idea of the market’s total scope.

- Bottom-Up Approach: The bottom-up approach is more specific. Here, VCs analyze company data—like actual sales, product pricing, and customer behavior—to build TAM from the ground up. They look at how many units could realistically sell and what that means for potential revenue.

- Value-Theory Approach: In the value-theory approach, VCs estimate TAM based on the startup’s unique value to customers. This method focuses on customer willingness to pay, analyzing how the product addresses specific needs. By looking at the price customers are willing to pay and matching it to demand, VCs can get a better sense of TAM from a value-based perspective.

Using these approaches, VCs balance industry estimates with concrete data, which helps them decide if a startup has strong potential. Accurate TAM assessments play a vital role in investment decisions.

For a more detailed look into TAM and how to calculate it, check out our Total Addressable Market (TAM) guide.

Each of these methods has its strengths, and many VCs use a mix to validate a startup’s TAM. Startups that can demonstrate a well-researched TAM using one or more of these approaches stand a better chance of attracting VC interest.

The Role of TAM in VC Evaluation

Venture Capitalists (VCs) assess Total Addressable Market TAM to gauge the potential market opportunity and forecast a startup’s growth potential. By understanding the size of the market, VCs can determine the scalability of a business and its ability to capture market share.

Indicators of Market Potential: TAM serves as a key indicator of market opportunity. It represents the total revenue opportunity available if a product or service achieves complete market penetration. A substantial TAM suggests a wider market opportunity, which is crucial for VCs looking to invest in ventures with significant growth potential.

VCs often use TAM alongside other metrics like SAM (Serviceable Available Market) and SOM (Serviceable Obtainable Market) to fine-tune their evaluation process.

By analyzing these numbers, they can better understand how much of the market a startup can realistically capture. This analysis aids in making informed investment decisions based on concrete data rather than speculation.

Understanding TAM also helps in comparing startups within the same sector. A startup with a larger TAM might be perceived as having more long-term potential. Thus, it plays a critical role in investment prioritization.

TAM as a Metric for Scalability: Scalability is a significant factor in venture capital evaluation, and TAM acts as a metric to gauge this. A large TAM indicates the potential for a startup to grow and expand its operations without being constrained by market size. VCs see this as an opportunity to achieve substantial returns on their investments.

For VCs, TAM is not just about current market size. It’s about how a company can scale its operations effectively.

By evaluating TAM, investors can project how the startup might perform as it scales, considering factors like increased production, efficient distribution, and market share capture.

Additionally, VCs look at how the startup plans to expand its market reach. This involves strategies for increasing customer base and market share. Thus, a clear and compelling TAM can significantly influence a VC’s decision to back a startup.

Key Financial Metrics: Crucial metrics include Customer Lifetime Value (CLV) and the Churn Rate.

CLV estimates the total revenue expected over a customer’s relationship with the business. A higher CLV suggests better profitability.

On the other hand, understanding the churn rate is essential. A high churn rate can indicate problems with customer retention.

Financial Projections are used to show future earnings and expenses. They serve as a roadmap for growth and help investors understand the financial health of the business.

These projections combined with a solid understanding of financial metrics provide a comprehensive view of the startup’s potential success.

Key Considerations for TAM Valuation

When evaluating TAM, venture capitalists consider several factors and criteria to ensure the market size aligns with the startup’s growth potential. TAM numbers can vary widely depending on data quality and calculation methods, so VCs look for reliable, realistic figures that suggest actual revenue possibilities.

Here are the key points VCs focus on in TAM valuation:

Minimum TAM for a VC

VCs often have a minimum TAM threshold in mind for an investment. While this can vary, most investors look for a TAM large enough to support high growth. Generally, VCs expect a TAM in the billions for tech and scalable industries. A smaller market may not offer the returns VCs need to justify investment. As I’ve observed through my experience at Globemonitor, startups in large addressable markets attract far more VC attention. For a venture to be worth the risk, VCs want to see a clear path to substantial revenue within a sufficiently large TAM.

Conversion Rates: TAM to Paying Users

Not all potential customers will become paying users. VCs look for realistic estimates of what percentage of TAM can convert into paying customers. Startups that present realistic conversion rates show they understand their customer base and can turn market potential into revenue. A TAM of $10 billion might seem impressive, but VCs want evidence that a significant portion will translate into actual sales.

Distinguishing TAM from SAM and SOM

A common misunderstanding is treating TAM as the actual market the startup can reach. VCs need clarity between TAM (total market), SAM (the serviceable market), and SOM (the obtainable market). They know that TAM gives the overall picture, while SAM and SOM reveal the specific portions of the market the startup can realistically capture.

For more on these distinctions, see our posts on Serviceable Addressable Market (SAM) and Serviceable Obtainable Market (SOM)

Market Dynamics and Competition

VCs consider how market changes and competitors might affect TAM. An estimate that ignores industry trends or emerging competitors may look unreliable. VCs appreciate startups that consider factors like market growth, new entrants, and technological shifts when calculating TAM, as it shows a deeper market understanding.

Data Reliability and Sources

The credibility of TAM data matters. VCs often look at where startups source their TAM data. Relying on established market research reports or credible data sources builds trust. When startups back their TAM with solid, verifiable sources, it demonstrates thorough research, adding credibility.

By carefully evaluating these factors, VCs get a realistic view of a startup’s market potential. A clear and accurate TAM, along with realistic expectations on customer conversion and market reach, is crucial for startups seeking funding. These considerations are essential in convincing investors of the startup’s long-term potential.

Team and Execution Capability

A startup’s success often hinges on the strength of its team and their ability to execute strategies effectively. Venture capitalists pay close attention to these factors, evaluating both the founding team’s strengths and their previous track records in strategic execution.

Founding Team Analysis: Venture capitalists often scrutinize the skills, experience, and dynamics of the founding team.

This includes assessing their ability to work together and handle challenges. A team with diverse skills increases a startup’s chances of adapting to various market needs.

Investors look for leaders who have previously demonstrated resilience and problem-solving abilities.

The academic and professional backgrounds of founders can add credibility. For instance, those who graduated from prestigious institutions like Harvard Business School may bring valuable networks and insights.

Founders who actively seek coaching or mentorship are seen as proactive and open to continuous improvement. These qualities can make or break a startup’s future growth potential in the eyes of investors.

Execution Track Record: An established execution track record provides evidence of a team’s ability to turn ideas into reality.

This involves assessing past projects or startups that they have successfully led or contributed to.

Venture capitalists often look for milestones like achieving critical product development goals or meeting financial targets.

Venture capitalists pay attention to how effectively a team navigates operational and execution risks in their past efforts.

The more consistently a team overcomes challenges, the more confidence investors have in their ability to handle future uncertainties.

Demonstrated experience in scaling businesses is also crucial, as it indicates the team’s knowledge in managing growth stages.

Conclusion

For startups seeking venture capital, presenting a well-researched, realistic TAM is essential. VCs look at TAM not only to gauge the market’s potential size but also to assess the startup’s understanding of its reach and growth possibilities.

A credible TAM that meets the minimum size expectations for investors can make a startup stand out and strengthen its funding prospects.

Venture capitalists prioritize accuracy in TAM projections. They value startups that can clearly explain how they derived their TAM figures, distinguish between TAM, SAM, and SOM, and estimate conversion rates from TAM to paying customers.

This clarity reassures investors that the startup has a grounded, data-backed view of its market opportunity.

By combining credible data sources with thoughtful projections, founders can improve their chances of securing investment. A well-defined TAM shows VCs that the startup has not only ambition but also a realistic plan for capturing its market.

Ultimately, accurate TAM valuation is a powerful tool that communicates both vision and credibility, helping startups build investor confidence and attract support.

Check out our Market Sizing Cheat Sheet for straightforward tips and frameworks!

FAQs

u003cstrongu003eHow do VCs evaluate TAM of a startup?u003c/strongu003e

VCs use a mix of approaches to evaluate TAM, including the top-down (industry data), bottom-up (company-specific data), and value-theory (customer willingness to pay) methods. These methods help them understand the startup’s full revenue potential and growth prospects.

u003cstrongu003eWhat is the minimum TAM for a VC?u003c/strongu003e

Most VCs look for a minimum TAM in the billions for scalable industries. A large TAM signals that the market can support high growth, making it worth the investment risk.

u003cstrongu003eWhat percentage of the TAM converts to paid users?u003c/strongu003e

This varies widely by industry and product, but VCs typically want startups to provide realistic estimates of how much of the TAM can be reached and converted into paying customers. High conversion rates show strong market demand and realistic revenue potential.

u003cstrongu003eIs the actual market the same as SAM?u003c/strongu003e

No. TAM represents the total market size, while SAM (Serviceable Addressable Market) is the portion of TAM that the startup can realistically target based on its product and reach.

A quick overview of the topics covered in this article.

Latest Posts

Subscribe to our newsletter

Get valuable insights and business guidance sent to your email.